This article is part of the FT’s Runaway Markets series.

A flood of central bank stimulus and widening interest among retail and institutional investors has sustained the rally in cryptocurrencies, analysts say, even as sceptics warn that the market is in the midst of a bubble.

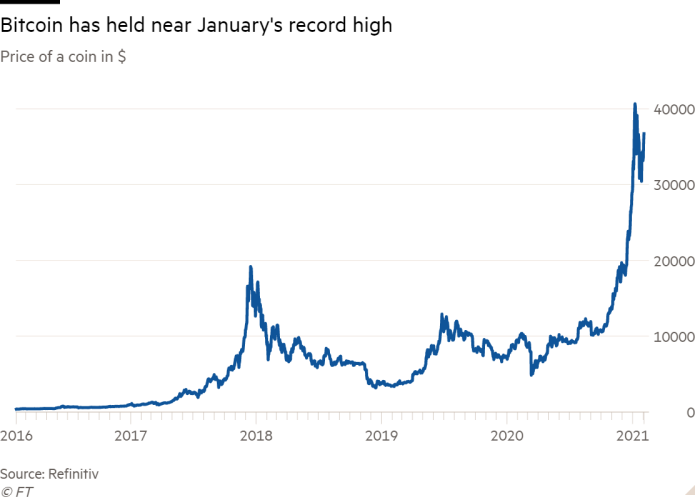

Bitcoin kicked off February at just above $36,000, about $5,000 beneath the all-time peak it hit last month.

The digital currency briefly wobbled after reaching the high in early January, but has so far avoided a repeat of the brutal crash in 2017. Some investors put that down to a deluge of central bank stimulus, which has inflated the price of assets globally and triggered a frantic hunt for returns.

“The amount of liquidity that has been injected in the system has found its way into a lot of different assets, including alternatives such as bitcoin,” said Francesca Fornasari, a fund manager at Insight Investment.

At the same time, professional and amateur investors are beginning to play a more active role in the crypto market.

“In 2012 it was mostly geeks, anarchists and libertarians in crypto,” said Marc Bernegger, a Zurich-based board member of Crypto Finance Group, a broker and asset manager. “The profile of people entering into bitcoin has definitely changed.”

Many remain sceptical, however, and worry that the sharp price rises reflect increasingly frothy market conditions. For them, bitcoin’s gains echo the recent volatility in share prices of companies like GameStop and AMC Entertainment, as well as a sudden surge this week in the price of silver.

The moves in all three markets involved an influx of retail traders, armed with increasingly sophisticated tools and often stuck at home because of coronavirus lockdowns. Some brokerages such as Robinhood allow traders to bet both on the price of stocks and cryptocurrencies.

Since a sharp fall during the broad market ructions last March, bitcoin’s value has increased by nine times. The boom has caused parts of the traditional financial community to take notice, with some banks beginning to cover the market as part of their research offerings.

San Francisco-based Coinbase is preparing for a direct listing that would give investors their first chance to buy shares in a big US-listed cryptocurrency exchange.

The planned debut comes as investors are already chasing other proxies for investing in digital tokens without having to hold them outright. Last year, investors poured $5.7bn into cryptocurrency trusts managed by Grayscale, the favoured investment channel of many traditional traders dipping their toes into bitcoin. The figure amounted to more than four times the total net inflows between 2013 and 2019. Most of Grayscale’s inflows come from institutional investors.

Data from Chainalysis, a specialist cryptocurrency analytics company, also show an increase in institutions’ purchases of bitcoin, and a rise in average transaction sizes since November.

Runaway Markets

In a series of articles, the Financial Times examines the exuberant start to 2021 across global financial markets

Joshua Younger, a strategist at JPMorgan, said the size of the bitcoin market had grown to equal about a fifth of gold held for investment and trading purposes, with a market capitalisation for the cryptocurrency of $750bn at its peak earlier this year, meaning it “is far from a niche asset class”.

The lure of the high-risk space is increasingly difficult to ignore. “You’re not buying bitcoin to make 20 per cent, you’re buying it to make exponential returns,” said Brett Messing, a partner and chief operating officer of cryptocurrency specialist hedge fund SkyBridge Capital.

Analysts at Canadian insurance company Manulife said in late January that the expansion in central banks’ balance sheets and rising public debt would push investors further into alternative asset classes, which could turn cryptocurrencies into “a solution to investor fears that ongoing extraordinary policy support could lead to resource misallocation”.

“This doesn’t necessarily imply that investments in cryptocurrencies are appropriate, but it does suggest that cryptoassets such as bitcoin will increasingly become a standard point of reference for investors and policymakers alike,” Manulife said.

Tell us. What else would you like to learn about this story?

Complete a short survey to help inform our coverage

But scams and hacks also remain rife, with a recent report from data company Xangle showing that investors have lost more than $16bn to fraud since 2012. Regulators are also increasingly concerned about the size of the market and the unchecked activity taking place every day.

Agustín Carstens, the head of the Bank for International Settlements said last week that “it is clear that bitcoin is more of a speculative asset than money”.

Michael Bolliger, chief investment officer at UBS Wealth Management, added that the history of bubbles showed that they could stay inflated for longer than most expected, sometimes without bursting.

“Changes in the way assets are perceived can also mean that bubbles may never fully deflate, and this could hold true for cryptocurrencies, too,” Mr Bolliger said.

The Link LonkFebruary 04, 2021 at 12:00PM

https://www.ft.com/content/c6463b9b-4fab-4376-a1b9-e7ec7847cfcf

Bitcoin boom backstopped by central banks' easy-money policies - Financial Times

https://news.google.com/search?q=easy&hl=en-US&gl=US&ceid=US:en

No comments:

Post a Comment